The 9-Second Trick For Clark Wealth Partners

Clark Wealth Partners for Dummies

Table of ContentsSome Known Questions About Clark Wealth Partners.Things about Clark Wealth PartnersExamine This Report about Clark Wealth PartnersClark Wealth Partners Fundamentals ExplainedClark Wealth Partners - TruthsSome Ideas on Clark Wealth Partners You Should KnowClark Wealth Partners Things To Know Before You Get This

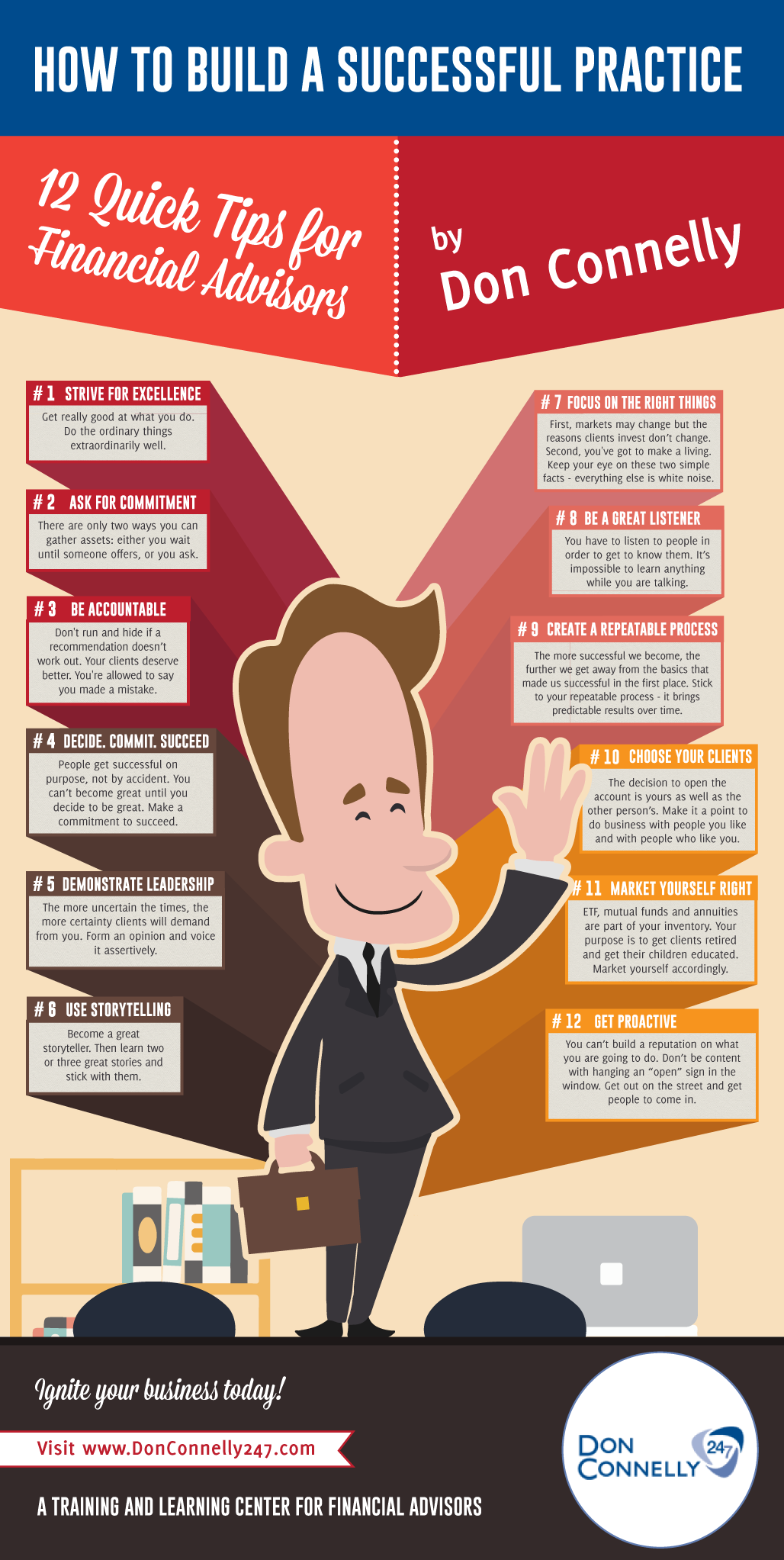

The world of finance is a complex one. The FINRA Foundation's National Capacity Study, for instance, just recently located that almost two-thirds of Americans were unable to pass a standard, five-question economic proficiency examination that quizzed participants on topics such as passion, financial debt, and other reasonably fundamental principles. It's little wonder, then, that we frequently see headings lamenting the poor state of most Americans' funds (Tax planning in ofallon il).Along with managing their existing clients, financial experts will certainly typically spend a reasonable amount of time each week meeting with potential customers and marketing their solutions to preserve and expand their company. For those considering ending up being a monetary advisor, it is essential to think about the average wage and work stability for those working in the area.

Programs in taxes, estate preparation, financial investments, and threat management can be useful for students on this course. Relying on your unique job goals, you may also require to gain certain licenses to fulfill certain clients' demands, such as purchasing and offering stocks, bonds, and insurance policies. It can likewise be helpful to make a certification such as a Qualified Financial Coordinator (CFP), Chartered Financial Analyst (CFA), or Personal Financial Expert (PFS).

7 Simple Techniques For Clark Wealth Partners

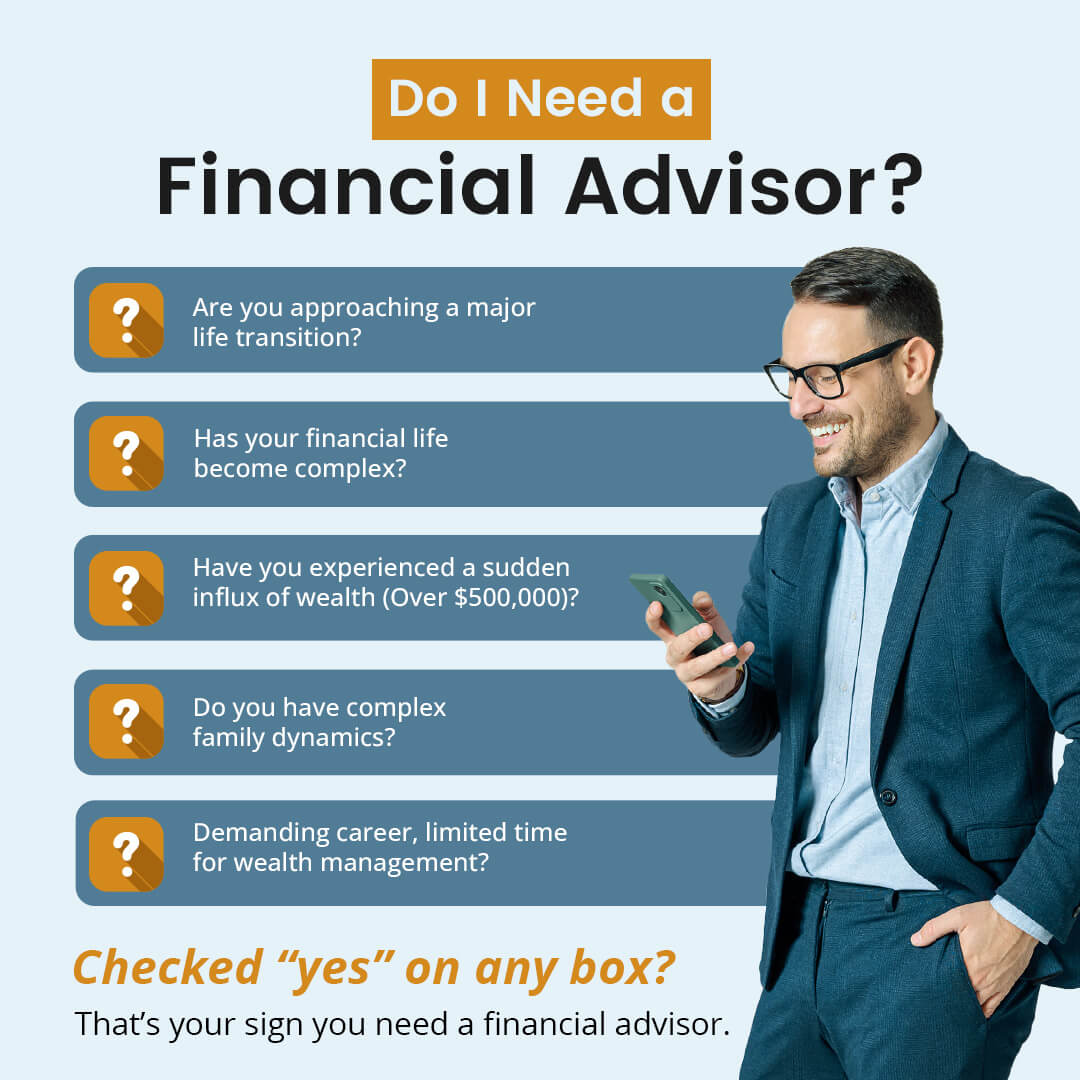

Lots of people make a decision to obtain help by using the solutions of a monetary specialist. What that resembles can be a variety of points, and can vary depending upon your age and phase of life. Before you do anything, research study is vital. Some people fret that they require a specific quantity of money to spend prior to they can obtain help from a professional.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

If you haven't had any experience with a monetary advisor, below's what to expect: They'll start by giving a complete analysis of where you stand with your assets, liabilities and whether you're meeting standards contrasted to your peers for financial savings and retirement. They'll examine brief- and long-term objectives. What's helpful concerning this step is that it is individualized for you.

You're young and functioning full time, have a cars and truck or two and there are trainee fundings to pay off.

Everything about Clark Wealth Partners

You can go over the next best time for follow-up. Financial experts typically have different tiers of pricing.

You're looking in advance to your retired life and assisting your children with greater education and learning costs. An economic expert can supply advice for those situations and more.

An Unbiased View of Clark Wealth Partners

Set up normal check-ins with your organizer to fine-tune your strategy as needed. Balancing cost savings for retired life and university prices for your youngsters can be challenging.

Thinking of when you can retire and what post-retirement years may look like can produce issues about whether your retired life savings remain in line with your post-work strategies, or if you have conserved sufficient to leave a heritage. Assist your monetary specialist comprehend your method to money. If you are a lot more conservative with conserving (and potential loss), their tips must react to your fears and issues.

The Clark Wealth Partners Statements

For example, preparing for healthcare is one of the large unknowns in retired life, and an economic professional can outline choices and recommend whether additional insurance coverage as defense might be valuable. Prior to you start, try to obtain comfortable with the concept of sharing your whole financial photo with a specialist.

Providing your professional a complete picture can help them create a strategy that's prioritized to all parts of your economic condition, specifically as you're fast approaching your post-work years. If your finances are straightforward and you have a love for doing it yourself, you might be fine on your very own.

A financial expert is not just for the super-rich; any individual encountering significant life changes, nearing retirement, or sensation bewildered by monetary choices might gain from professional guidance. This short article explores the duty of financial consultants, when you might require to seek advice from one, and vital considerations for selecting - https://www.pinterest.com/pin/900368150514394496. A financial advisor is a skilled expert that helps clients manage their funds and make notified decisions that line up with their life goals

Facts About Clark Wealth Partners Uncovered

In contrast, commission-based experts gain earnings with the monetary items they offer, which may influence their suggestions. Whether it is marital relationship, divorce, the birth of a kid, job adjustments, or the loss of an enjoyed one, these events have special financial ramifications, usually needing prompt choices that can have long-term effects.