Not known Incorrect Statements About Clark Wealth Partners

Clark Wealth Partners - Truths

Table of ContentsAn Unbiased View of Clark Wealth PartnersSome Of Clark Wealth PartnersNot known Facts About Clark Wealth PartnersThe 5-Minute Rule for Clark Wealth PartnersThe Definitive Guide for Clark Wealth PartnersNot known Details About Clark Wealth Partners Clark Wealth Partners Fundamentals ExplainedSome Of Clark Wealth Partners

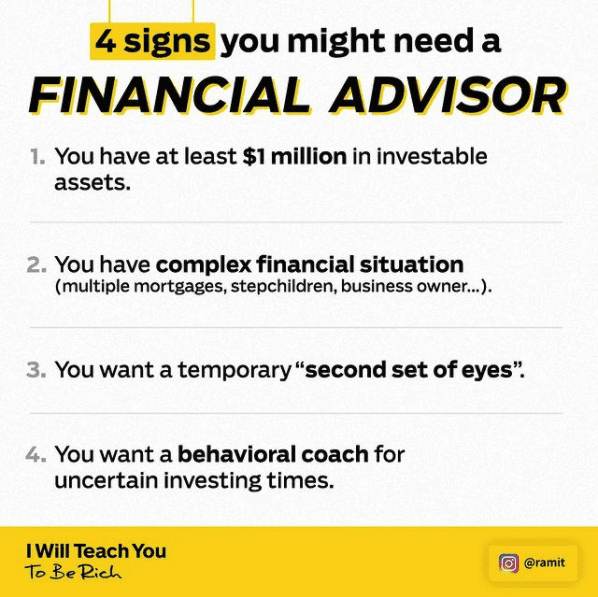

Typical reasons to take into consideration an economic consultant are: If your financial scenario has actually ended up being more complex, or you do not have self-confidence in your money-managing skills. Saving or browsing major life events like marital relationship, divorce, kids, inheritance, or job adjustment that may significantly impact your financial circumstance. Browsing the change from conserving for retired life to maintaining wide range throughout retired life and exactly how to develop a solid retired life earnings strategy.New innovation has caused more thorough automated financial tools, like robo-advisors. It depends on you to investigate and establish the ideal fit - https://penzu.com/p/10bc905112757bff. Inevitably, a great economic advisor needs to be as mindful of your financial investments as they are with their very own, staying clear of excessive charges, saving money on taxes, and being as clear as feasible about your gains and losses

Facts About Clark Wealth Partners Uncovered

Making a payment on item referrals does not always imply your fee-based advisor antagonizes your finest rate of interests. They may be more inclined to advise products and services on which they earn a compensation, which might or may not be in your finest rate of interest. A fiduciary is lawfully bound to place their client's rate of interests.

They might follow a loosely checked "viability" criterion if they're not signed up fiduciaries. This conventional enables them to make recommendations for investments and solutions as long as they fit their client's goals, risk resistance, and monetary situation. This can translate to referrals that will certainly likewise make them money. On the other hand, fiduciary consultants are legitimately bound to act in their customer's finest passion instead of their own.

Some Known Details About Clark Wealth Partners

ExperienceTessa reported on all things spending deep-diving right into complex monetary topics, clarifying lesser-known investment avenues, and revealing ways viewers can work the system to their benefit. As a personal money professional in her 20s, Tessa is acutely familiar with the effects time and uncertainty have on your investment choices.

It was a targeted promotion, and it worked. Check out more Check out much less.

10 Simple Techniques For Clark Wealth Partners

There's no solitary path to coming to be one, with some people starting in banking or insurance policy, while others start in accounting. 1Most financial coordinators begin with a bachelor's level in money, business economics, accounting, company, or a related topic. A four-year level provides a strong structure for occupations in investments, budgeting, and customer solutions.

What Does Clark Wealth Partners Mean?

Common examples include the FINRA Collection 7 and Series 65 tests for safety and securities, or a state-issued insurance policy license for offering life or health insurance. While credentials might not be legitimately required for all intending duties, employers and clients commonly watch them as a standard of expertise. We take a look at optional qualifications in the next section.

Most financial coordinators have 1-3 years of experience and knowledge with financial products, conformity standards, and direct client communication. A solid instructional background is necessary, yet experience shows the ability to apply theory in real-world setups. Some programs combine both, enabling you to complete coursework while making monitored hours via teaching fellowships and practicums.

The 8-Second Trick For Clark Wealth Partners

Early years can bring lengthy hours, pressure to company website build a client base, and the demand to consistently show your proficiency. Financial coordinators enjoy the possibility to function carefully with customers, guide vital life choices, and typically attain adaptability in schedules or self-employment.

They spent much less time on the client-facing side of the market. Almost all economic managers hold a bachelor's degree, and many have an MBA or comparable graduate degree.

Rumored Buzz on Clark Wealth Partners

Optional accreditations, such as the CFP, usually require extra coursework and testing, which can extend the timeline by a number of years. According to the Bureau of Labor Data, personal economic advisors make a median annual yearly income of $102,140, with top earners making over $239,000.

In other provinces, there are policies that need them to meet certain demands to utilize the economic advisor or economic planner titles (financial planner in ofallon illinois). What establishes some monetary experts aside from others are education, training, experience and certifications. There are many designations for monetary consultants. For economic planners, there are 3 typical designations: Certified, Personal and Registered Financial Coordinator.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

Where to find an economic advisor will depend on the type of suggestions you require. These institutions have team who might assist you understand and purchase certain kinds of investments.